The high cost of healthcare in the United States has sparked widespread debate, with many questioning whether health insurance companies are part of the problem. Critics argue that their profit-driven motives exacerbate affordability and equity issues. Insurance companies have a vested interest in reducing the cost charged by providers, still, healthcare expenditures in the US have increased significantly from 13.3% of GDP in 2000 to 18.3% of GDP in 2023. Last year is particularly important, because “the average single premium increased by 6% and the average family premium increased by 7%. Comparatively, there was an increase of 4.5% in workers’ wages and inflation of 3.2%. Over the last five years, the average premium for family coverage has increased by 24%, compared to a 28% increase in workers’ wages and inflation of 23%.”

Insurers are limited in their ability to control costs set by providers, revealing a deeper problem in the healthcare system. Insurance companies serve as intermediaries, connecting patients and providers. Their primary function is to pool risk by collecting premiums from many individuals and using these funds to pay claims. In theory, this should reduce the financial burden on individuals by spreading costs across a larger population. Insurance companies operate as profit-driven entities, prioritizing risk management and cost containment.

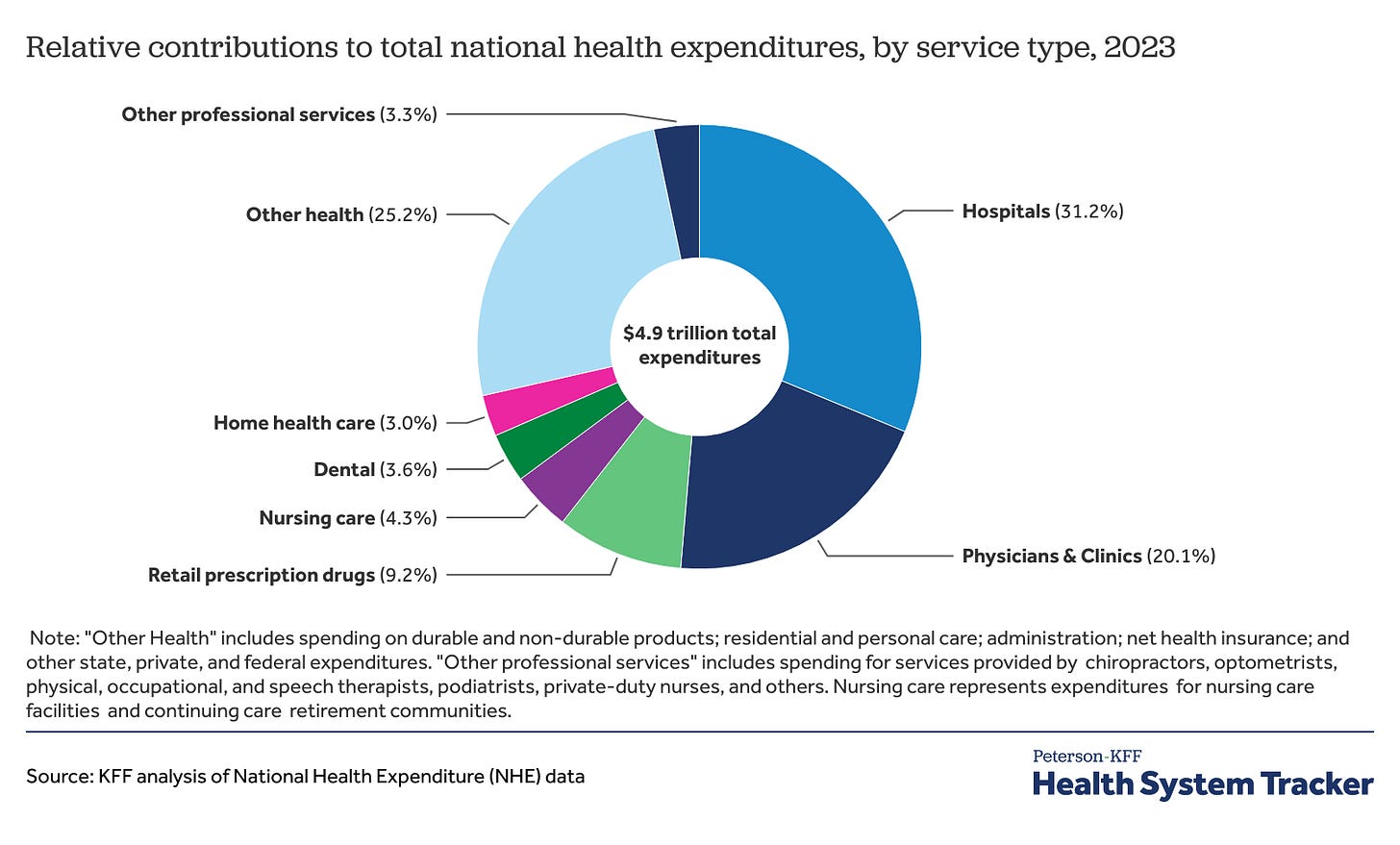

The U.S. healthcare system involves three main actors: providers, insurance companies, and patients. Providers, such as hospitals and physicians, determine medical service prices. Insurance companies negotiate these prices and reimburse providers on behalf of patients. Patients receive services but often have limited knowledge of or influence over costs. For illustration purposes, compare to the case of car insurance: when you have an accident, the body shop charges a fee, and the insurer pays it. Car insurance companies have an incentive to see a competitive market of body shops.

The free market thrives on competition, consumer choice, and price transparency, which collectively drive efficiency and innovation. However, the U.S. healthcare system operates far from this ideal. Consumers predominantly prefer insurance to cover costs, reducing their sensitivity to prices and diminishing their role in market competition. Meanwhile, healthcare providers often lack incentives to reduce costs, as revenue structures and market dynamics favor higher spending. These challenges are compounded by the imperfect nature of the healthcare market, characterized by limited transparency, barriers to entry, and unequal access to information, all of which contribute to escalating costs.

However, in healthcare, some providers often wield significant pricing power. Some healthcare services, such as primary care and pharmacies face competition. However, other services, such as hospitals or treatments that require large investments, enjoy more monopoly power. Additionally, serious conditions face an inelastic demand on the part of patients. Limited competition among providers exacerbates the issue. Large hospital systems dominate in many regions, allowing them to set high prices without fear of losing patients. Additionally, providers can send bills after services are rendered, leaving patients no opportunity to negotiate or compare costs. Unlike other markets, where price transparency enables consumers to make informed decisions, healthcare often operates in an opaque manner. Insurance companies, caught between providers and patients, pass these rising costs onto consumers through higher premiums and deductibles.

Insurance companies are often blamed for rising healthcare costs because, while they aim to reduce expenses, they are constrained by regulations that limit their ability to negotiate effectively with providers. This dynamic creates a system where incentives to maintain costs are weak across all parties, contributing to escalating prices. Although insurance companies have incentives to limit costs, their bargaining processes often paint them as villains, overshadowing their role as intermediaries. The U.S. health system is highly fragmented, involving numerous private and public payers whose regulation is divided between state and federal governments.

In conclusion, while insurance companies play an essential role in the U.S. healthcare system, they are not the sole cause of its high costs. Providers’ pricing power, inelastic demand for healthcare, and limited competition significantly contribute to the problem. Reforming the system will require coordinated efforts to increase competition, enhance transparency, and realign incentives. Only by addressing these deeper systemic issues can the U.S. healthcare system move closer to providing affordable, equitable care for all its citizens.

Prince Acheampong | Research Assistant | poacheampong@miners.utep.edu

The views represented here are those of the author and do not represent the position of The University of Texas at El Paso or the Center for Free Enterprise.